Additive manufacturing. The very name of the technology hints at its positive power to change the world. Only a few decades on from early experiments with 3D printing in Japan in the 1980s almost every industry is being uplifted by its industrial application: additive manufacturing, aka AM or, simply, additive.

Medical, aerospace, automotive, energy and consumer products are capitalizing on the iterative, customizable and customer-centric capabilities of additive. The technology has evolved from prototype-building to production-scale manufacturing, with unprecedented speed and unimagined flexibility the wind at its back.

Business models, design and manufacturing processes and supply chains are rapidly transforming to integrate additive into operations and most agree that embracing additive is already an urgent imperative rather than nice-to-have innovation. Spending on additive or 3D printing was predicted to reach $US13.8 billion in 2019, up 21.2% YOY, according to The Worldwide Semiannual 3D Printing Spending Guide, produced by market-intelligence analysts International Data Corporation. By 2022, IDC experts predict spending to be almost $US22.7 billion.

For Baker Hughes, additive is key to digital transformation and an opportunity for both the company and its customers to take their businesses to a new frontier.

“We’ve produced more than 25,000 additive parts and qualified more than 450 individual parts,” says Aaron Avagliano, Senior Director, Advanced Manufacturing. “It’s growing at a very fast pace – in 2019 we qualified as many parts in a year as we did in all the previous years we’ve been working on it.”

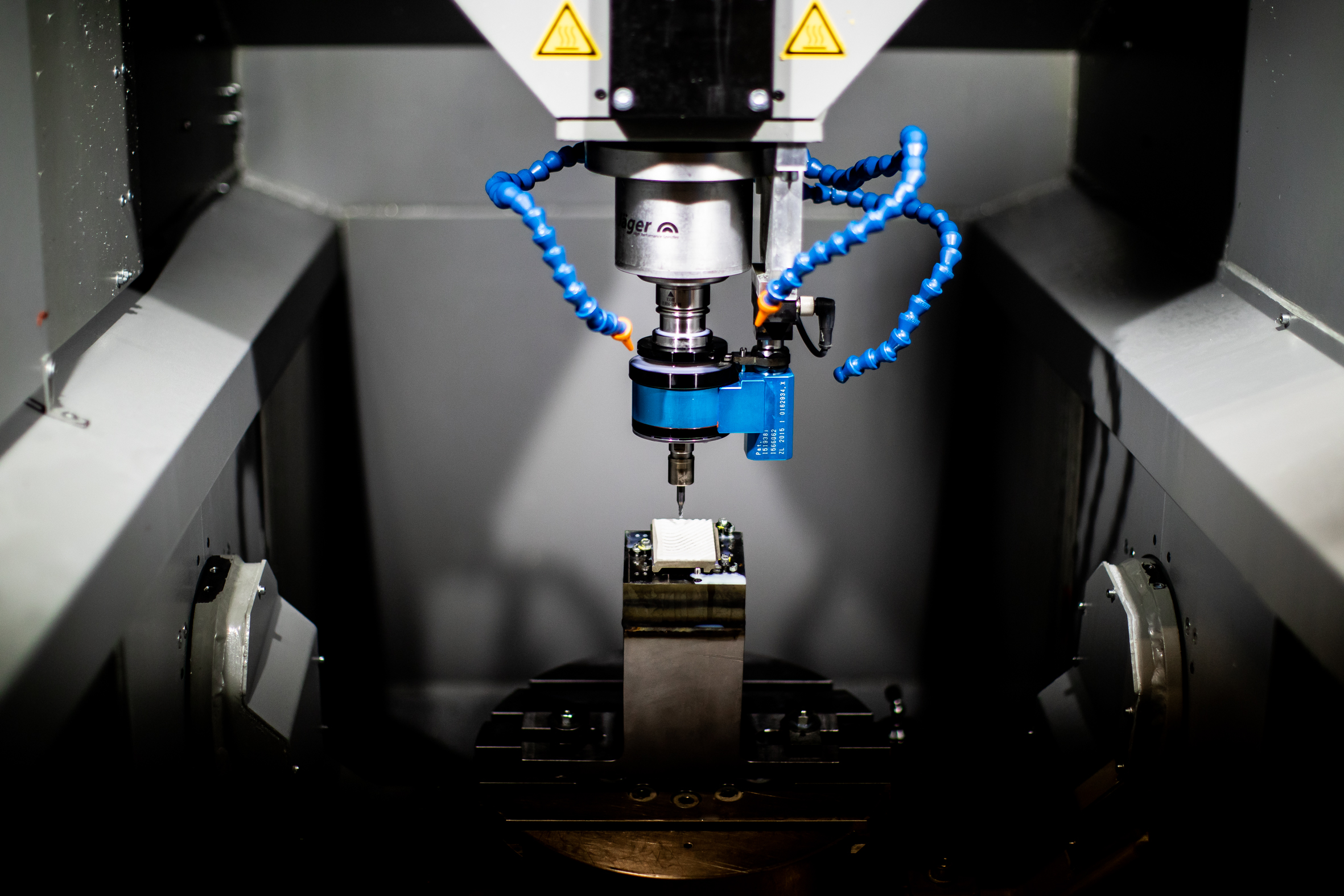

Baker Hughes additive centers are around the globe, from the US to the UK and Europe, from Asia to the Middle East, and investment is growing, with new machines and modalities coming online at speed. “Additive manufacturing is a tool that allows ideas to become reality in a very short time,” says Edoardo Gonfiotti, New Technology Introduction Engineer at the Baker Hughes Additive Center of Excellence in Florence, Italy.

For Baker Hughes engineers and designers, additive is also an essential part of the company’s commitment to driving carbon reduction initiatives for itself and its customers.

“This is a key enabler if you want to be an important player in the carbon-footprint reduction landscape and the overall emission-reduction OEM landscape,” says Gonfiotti. Additive manufacturing greatly reduces materials waste and cuts shipping distances, improving the overall efficiency of the production and supply-chain process. The parts themselves are lighter and many are already out-performing their subtractive-manufacturing ancestors. “Additive design has the possibility to create parts that could not be made nor even thought of in the past. The design boundaries have been enlarged in a very significant way, so that product developers can do things that were not possible to be done in the past. And additive allows innovation in a very different time frame to traditional manufacturing processes.”

Gonfiotti notes that while in the past manufacturing R&D moved slowly in line with the limitations of heavy machinery technology, additive is exponentially lighter on its feet. “A designer who is developing something and has a question, they can get close to a real-time answer,” he says. “The boundaries of development have become significantly wider, enabling our company goals of pursuing designs to help lower emissions – and doing it at speed. These are the two things that I see as really important for the company and for oil and gas development and change in the next few years. I’m not talking about decades, I’m talking about just a few years.”

Layer upon layer of additive proof points

The World Economic Forum names additive manufacturing as one of the key megatrends of the Fourth Industrial Revolution, aka 4IR. “In additive manufacturing, customization and complexity are no longer limiting cost factors,” declared its Reshaping Global Value report of September 2019. “The rapidly growing list of compatible materials has greatly expanded the potential for additive manufacturing to disrupt different fields, from agriculture and biology to design and manufacturing. This technology has already eliminated the need for a large amount of highly skilled labor and the associated surges in manufacturing costs.

“Blending AI, robotics and IoT [Internet of Things] with additive manufacturing creates entirely new possibilities for who makes what, and where. Specifically, manufacturers will no longer have to rely on multiple stakeholders scattered across geographies. These technologies will enable them to bring much or all of their production back to their home bases and switch to just-in-time models. As a result, businesses could benefit from major reductions in shipping and inventory costs; near elimination of lead time; a lower risk of intellectual property theft; increased cooperation between stakeholders; faster response to changing market dynamics; and more efficient logistical flows.”

Industry leaders agree that moving to additive is no longer an option, it’s business critical. Gartner’s 2019 Hype Curve for 3D Printing put many areas of additive manufacturing past the ‘peak of inflated expectations’ and heading up the ‘slope of enlightenment’ or further along, on the ‘plateau of productivity’.

Pete Basiliere was Gartner’s 3D printing analyst before founding his own specialist consultancy, Monadnock Insights, late in 2019. He lays out the customization benefits of additive with a touch of history: “Why do consumer goods companies insist on making one-size-fits-all products? The answer lies in how new products are developed. Marketers survey customers to learn their preferences. They collect the data, find the common elements that most customers want and then submit a feature set to engineering. Engineering looks at the feature set and tosses out elements that are not possible with existing technology. Then manufacturing management looks at the design and says ‘Well, we have to toss out these features if you want to make money.’ The stripped-down product is designed for manufacturing, not the customer.”

The beauty of additive is that it enables “the shift from design for manufacturing to manufacturing the ideal design,” he writes. “Now we can listen to the customer and produce what they need and want.”

Simplifying the process to design and print superior parts ‘just in time’

Industry veteran Greg Folks, Senior Director Additive Manufacturing in Houston, Texas, has worked with Baker Hughes for more than three decades and he is delightedly watching manufacturing transform before his eyes. “Today there are design engineers and manufacturing engineers: The first group designs products, the second designs the process to build, say, the car after it’s been designed,” he explains of a non-additive manufacturing line. “If you do it really well, you collaborate through that process, but they are two distinct disciplines and areas of responsibility.”

Additive effectively concertinas this process, and is progressively ousting the siloed approach of manufacturing design. “In the future, the person who designs the product will also define the process to optimally create it,” says Folks. “Within our group and at our additive centers around the world we have engineers who have traditionally been design engineers or process engineers and they are already becoming one.”

Across Baker Hughes, everyone from sourcing to manufacturing is alert for additive opportunities. “If someone has a product that might be improved by additive, or a problem where additive might be a solution, we will collaborate with a materials scientist and a design engineer and possibly with supply chain,” explains Folks. “But when we use the additive process, we’re always simplifying the supply chain because we’re greatly reducing the number of steps required to produce the product.”

Scott Parent, Baker Hughes Vice President Engineering and Technology explains that “additive is a building block of the Fourth Industrial Revolution.” As data – possibly collected from sensors themselves manufactured by additive processes – and AI and machine learning paired with additive capabilities, the opportunities get even more exciting.

“One example would be of sensors monitoring products during operation. We will analyze the sensor data and use machine learning to predict when a part is needed to maximize the performance, or uptime of that product,” explains Parent. “We’d have digital files – which are build files for additive machines – for qualified parts and we can build them quickly in our additive ecosystem, minimizing rig or plant downtime without holding physical inventory.”

“The ability to decentralize manufacturing though additive is creating a business model that was not envisioned before,” says Anjani Achanta, Executive Director, Additive Manufacturing at Baker Hughes Additive Manufacturing Technology Center in Houston, Texas. “Having a digital inventory rather than carrying it physically, and the possibilities for on-demand manufacturing in remote locations is a real game-changer,” she adds.

“We have already been able to create parts for customers in emergency situations when they’ve had a field failure and need a quick replacement part, we’ve been able to produce it in days versus months to get the operation back up and running.”

The nuts and bolts of additive for mass customization

As the report Metals 3D Printing from PwC consulting arm Strategy& noted in July 2019: “As metals AM continues to evolve, manufacturing industries will embrace the technology as a fundamental and critical part of the value chain. That point is getting closer by the day — unlocking more and more value as it does so, en route to fundamentally changing the way we manufacture.”

Bakers Hughes’ Avagliano agrees. “We are transforming how we design products and leveraging other transformative technologies to accelerate additive – it’s not something we’re doing as a stand-alone initiative– we’re integrating it into how we do business,” he says. Like his colleague Avagliano, Parent stresses that additive is not stand-alone, it’s a critical part of the fourth industrial revolution: “We are building an ecosystem around additive to pull in machine learning, artificial intelligence, generative design, and collaborating with Baker Hughes vendors and partners to go fast with these initiatives.”

“Additive allows you to do custom manufacturing without additional costs,” he adds. “If someone asks for 10 different-looking parts, we can produce them all on the same build at the same time, without adding any extra tooling or development costs. This ability for mass customization is an enormous benefit.”

A growing additive footprint

Baker Hughes Additive has taken big, fast strides around the world in just a few years. The first Baker Hughes additive manufacturing centers were opened in Houston, Texas and Florence, Italy in 2013. “We had just those two facilities all the way through to the end of 2014, and today we have seven locations,” says Folks.

The company’s additive centers now include Florence and Talamona in Italy, Celle in Germany, Houston, Texas in the US, Kariwa in Japan, Aberdeen in Scotland, and Dhahran in the Kingdom of Saudi Arabia.

“Here in Houston we spend roughly half our time on building parts and half our time on developing materials and processes,” says Folks. “The materials and processes for additive are integrated – you really can’t develop one without the other. About half of our time is material qualification, material development, process development.”

Folks says of the seven modalities or process types for additive (for which there are numerous derivatives under each), the Houston additive center works with four modalities and multiple materials, with new machines and modalities coming on line progressively.

“Staying current as the technology advances is a key role the Houston Center provides. We do this by evaluating AM startups, engaging with Universities and currently participating in consortiums,” he says.

In Saudi Arabia, the Dhahran Technology Center (known as DTC 4.0) is both an R&D and production facility in the heart of Dhahran Techno Valley, the kingdom’s innovation ecosystem and is housing the 1st industrial 3D printer for metal in Kingdom. The center is strategically located on Academia land, alongside both the largest NOC in the world and the largest Baker Hughes operations globally. Work here is focused on helping to accelerate digital transformation and other Industry 4.0 solutions for the regional customers.

“We are investing here as part of our commitment to do more research and development in country,” explains Ivo Nuic, Managing Director of DTC 4.0 for Baker Hughes. “DTC 4.0 is the first technology center of its kind in the kingdom, and we are perfectly placed to understand the key challenges and solve them in collaboration with our stakeholders. The whole industry is talking about Industry 4.0 or 4IR and we are proud that we’re already in action, globally and here in Dhahran.”

An additive part developed for a major client is the Rock Lock backup ring – the additive design permits a packer expansion range that is not possible with traditionally manufactured backup rings. “This completion product is a great example of a part where the performance enhancement can only be achieved through additive manufacturing,” says Achanta. “It was designed for additive, manufactured by additive and it has enabled a new product which can produce additional revenue far beyond what it used to. The backup ring allows large expansion when it’s deployed down holes, and the design means it’s now possible to run operations in a wide range of well bore sizes, so it’s opening up new opportunities for the customer by enhancing the performance of the part.”

Moving with an evolving landscape

Despite fast-track growth, additive is still a new technology, with fresh knowledge arriving as quickly as the products it’s producing. “One of our biggest challenges is educating our engineers and our supply chain folk not only on what additive can do today, but what additive can do 12 and 24 months from now,” says Achanta. “The technology is evolving so fast, that to take advantage of it and be a first mover, we have to anticipate and plan to use the capability that’s coming in advance of it being commercially available. It’s a real challenge for large companies to go at that kind of speed, but it is a big opportunity to accelerate our adoption of additive and differentiate ourselves as a company.”

This includes coming up with solutions for customers that will have a shelf life, as opposed to old models of an expected long life for a product or part, in line with the time it took to design and develop the traditional manufacturing process to make it. “We used to work in a way that we made products, and customers bought them, but the beauty of additive is that it allows us to make tailored solutions to meet the customer’s requirements in ways that was not possible before,” says Achanta.

“It’s where art, engineering and science come together.”

For more insights on moving manufacturing from fixed to flexible, you can read Anjani Achanta's full interview here.

Energy Forward Stories

Sign up to stay up to date on the latest innovations and people shaping the future of our industry.